To cut, or not to cut — that’s the billion-dollar question. In 2025, the Federal Reserve will be boxed into a corner by its dual mandate to encourage low inflation and low unemployment, two often competing goals.

Raising rates slows inflation but causes unemployment, while cutting rates lowers unemployment but sparks inflation. This year, the dynamic is even more complex because of the Trump administration’s new tariffs, which have significantly increased import costs across most industries and pressured prices higher.

In September a particularly troublesome August jobs report forced Fed Chairman Jerome Powell off the sidelines, resulting in a quarter-percentage-point cut to the Federal Funds Rate.

U.S. Unemployment rate in 2025 by month:

- August: 4.3%

- July: 4.2%

- June: 4.1%

- May: 4.2%

- April: 4.2%

- March: 4.2%

- February: 4.1%

- January: 4%

Source: Bureau of Labor Statistics.

The Fed next meets on Oct. 29, and this time around members of the policy-making Federal Open Market Committee have a problem. The government shutdown has delayed the Bureau of Labor Statistics’ report of the unemployment rate for September, leaving the central bank unclear about whether the job market is stabilizing.

Absent the BLS’s unemployment data for September, eyes turn to other gauges for clues. To help, Bank of America recently released its own employment update, shedding important light on what’s next for interest rate policy.

A Fed at risk of being behind the curve

The problem with inflation is that it’s cumulative. While inflation has retreated to 2.9% from its breakneck 8% level in 2022, according to the Consumer Price Index, it is stacked upon past price increases. So even 3% is straining consumer budgets.

Image source: Pugliano/Getty Images

The Fed appeared to have tamed inflation earlier this year when the rate reached 2.3% in April. However, it has since climbed back toward 3% following President Trump’s tariffs, which increased the effective tariff rate on imports to 17.9% from 2.4% in January, according to Yale Budget Lab.

The increased taxes have prompted many companies, including Walmart, AutoZone and Nike, to pass along at least some of the added cost burden to consumers.

Read more:

- Walmart’s new pricing strategy sparks customer, employee outrage

- Nike sends hard-nosed message on prices

- AutoZone makes harsh decision customers won’t like

It’s also pressured the Fed to avoid cutting interest rates for fear of further stoking inflationary fires — a decision that risks the Fed falling behind the curve if job losses mount and cause GDP to fall.

Bank of America releases latest jobs data

If jobs stabilize, the Fed can pause cuts, reducing the risk that inflation accelerates. If, however, unemployment continues to climb, it will likely mean lower rates — good news for borrowers, especially cash-strapped millennials struggling to buy homes.

In short, the stakes are high and the Fed is walking a tightrope. For now, the Fed seems more intent on protecting jobs, suggesting another cut is coming later this month. CME’s popular FedWatch tool currently pegs the odds of another quarter-point cut this month at 94%.

Bank of America’s recently reported September jobs data does little to change that thinking. The investment firm’s analysts conclude:

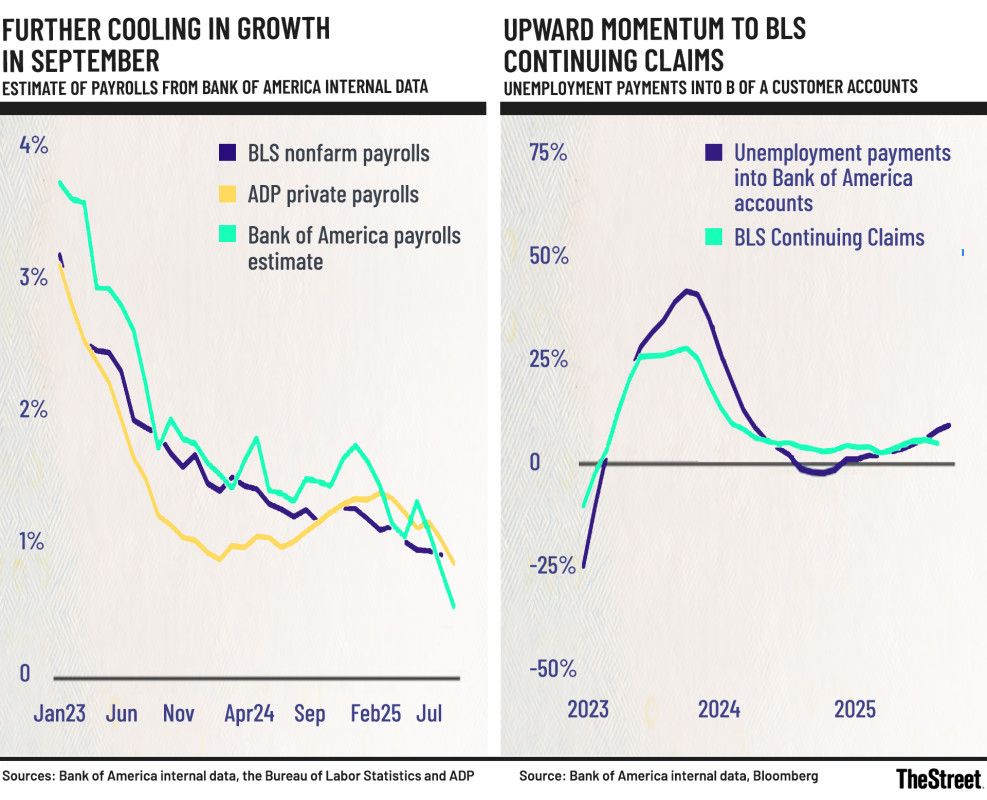

Bank of America crunched the numbers on customers receiving paychecks to reach its conclusion. It also tracked the number of customers receiving unemployment checks.

The data paint an employment picture worse than the already worrisome data released by payroll processor ADP. ADP said the U.S. economy lost 32,000 jobs last month, far below economists’ predictions for job growth.

According to Bank of America’s research, continuing unemployment claims increased in September, while payrolls continued to decline — a trend in place since 2023.

Bank of America Internal Data/Bloomberg

Bank of America analysts wrote,

In October, the year-over-year percentage rise in unemployment payments was around 10%, compared to a 5% YoY rise in BLS continuing claims in August. In our view, this suggests some upward momentum to unemployment.

If Bank of America’s data are a fair benchmark, more people are losing jobs, potentially increasing the unemployment rate from 4.3% in August, already the highest level since 2021.

That thinking is backed up not only by the poor ADP jobs data but by rising layoffs. According to Challenger, Gray & Christmas, U.S. employers laid off 202,118 workers in the third quarter, the most since Covid in 2020, and up 16% from last year.

The key takeaway? Bank of America’s peek under the hood at unemployment trends suggests that the Fed will again cut the Federal Funds Rate when it meets later this month.

Related: Fund manager resets forecast for what happens to stocks next