Our winner for the Middle East, Standard Chartered, continues to drive its regional expansion with ongoing technology investment and product innovation. The bank strives for an enhanced client experience using a simplified approach aligned with its global standard for client service. It accomplishes this through its robust custody platform, SeCCuRe, which handles the execution and monitoring of asset-servicing transactions across all markets it serves.

In addition to the recent launch of this service in Qatar, the bank upgraded the system that enables T+1 processing, new ISO 20022 messaging standards for proxy voting, and enhancements for the handling of corporate actions.

The bank continues to invest in technology and executive talent across the region to enhance systems and digital services. Moreover, to advance the sector and advocate for the requirements of its clients, senior bank executives hold leadership positions within key global industry associations and help shape the market infrastructure through a collaborative approach with regulatory bodies.

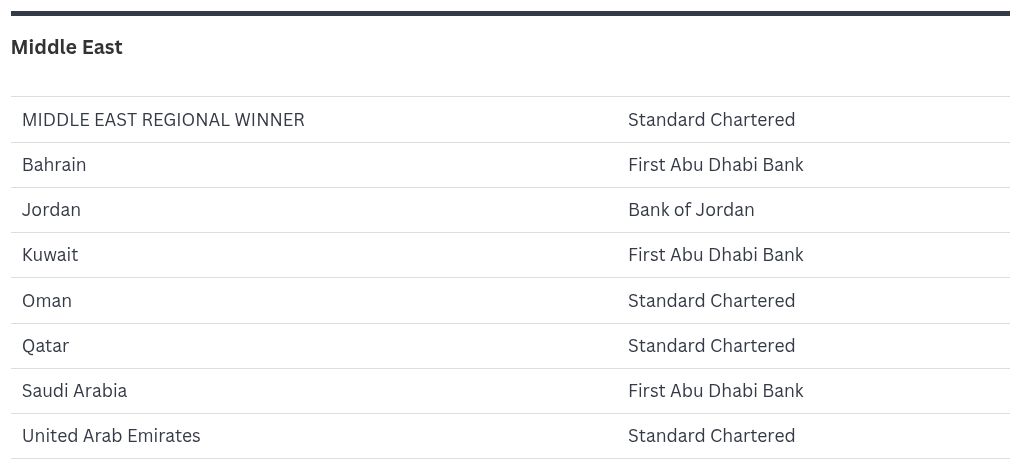

Standard Chartered is the country winner in Oman, Qatar, and the United Arab Emirates (UAE), reflecting its commitment to those countries and the region with new product solutions and high levels of client service. The bank’s footprint also extends to Bahrain. Standard Chartered has further expanded its presence and service capabilities in the Middle East with the launch of custody operations in Saudi Arabia.

The bank continues to demonstrate its innovation and market leadership in the UAE with its new digital asset custody offering. Additionally, it is the first international bank to act as a settlement bank for the Dubai Financial Market exchange and Nasdaq Dubai. Standard Chartered is the only provider in the market to offer complete end-to-end Islamic solutions that incorporate custody, cash management, and fund administration. In the Dubai International Financial Centre, Qatar, and the UAE, the bank expanded its transfer agent services through its ViTAL offering, which includes a convenient digital interface for accessing investment data and performance analytics.

Methodology

In selecting the institutions that reliably provide the best services in these local markets and regions, Global Finance’s editorial board considered market research, input from expert sources, and entry information from the banks themselves. The criteria included such factors as customer relations, quality of service, technology platforms, and post-settlement operations, as well as knowledge of local markets, regulations, and practices.

The post Best Sub-Custodian Banks in Middle East for 2025 appeared first on Global Finance Magazine.