The death of a family’s primary wage earner can bring profound emotional and financial hardship. In such moments, Social Security survivors insurance plays a vital role in helping families maintain some financial stability.

It provides income to the spouses, children, and sometimes even dependent parents of workers who pass away, offering a measure of security during a time of loss.

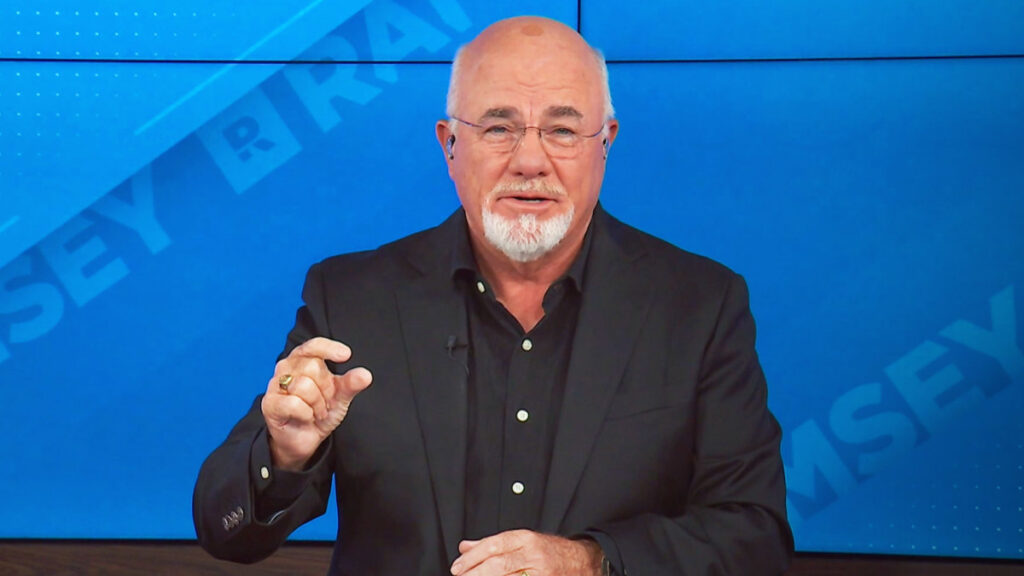

Bestselling personal finance author and radio host Dave Ramsey bluntly explains his perspective on the federal program and how it handles monthly paychecks for family members of would-be Social Security recipients who have passed away.

Answers to questions people have can be difficult to find, but the Social Security Administration offers guidance and support for those seeking more information about survivors benefits.

Related: Dave Ramsey bluntly speaks on 401(k)s, IRAs

Many Americans associate Social Security solely with retirement, but it serves a broader purpose. A portion of the taxes workers pay into the system goes toward survivors benefits, which often hold more financial value than a typical life insurance policy.

These benefits are designed to protect families, ensuring that when a worker dies, their loved ones may be eligible for support. This includes surviving spouses, divorced spouses under certain conditions, children, and dependent parents.

Dave Ramsey bluntly speaks on Social Security survivors benefits

Recognizing the difficulty of speaking about the sensitive subject, Ramsey engages in the discussion by simply stating his matter-of-fact views.

We know talking about death isn’t going to win you any friends at a party. But we have to talk about this stuff. Your spouse, children and other family members might qualify for survivor benefits that can replace some of your family’s lost income if you die.

Ramsey cites statistics from the SSA relevant to the point.

We hope your family is never in this position, but it’s comforting to know that your loved ones will have some money coming in if the unthinkable happens. Right now, almost 6 million people are receiving an average monthly survivor benefit of $1,510.

Image source: TheStreet

The Social Security Administration explains who receives survivors benefits

- Your surviving spouse may be able to get full

benefits at full retirement age, according to the SSA. The full retirement age

for survivors born from 1945 and 1956 is 66. The full retirement age for survivors increases gradually if

you were born from 1957 to 1962. For anyone born

1962 or later, full survivors’ benefits are payable at age 67. This is different from the full retirement age

for retirement benefits, which is 67 for people born in

1960 or later. - Your surviving spouse can get reduced

benefits as early as age 60. If your surviving spouse

has a disability, benefits can begin as early as age

50. Your surviving spouse may be able to get benefits at

any age if they take care of your child who is younger

than age 16 or who has a disability. The child must be

receiving Social Security benefits. - Your unmarried children, younger than age 18

(or up to age 19 if they’re attending elementary or

secondary school full time), may also be able to get

benefits. Your children can get benefits at any age

if they had a disability before age 22. Under certain

circumstances, we can also pay benefits to your

stepchildren, grandchildren, step-grandchildren,

or adopted children. - Your dependent parents may be able to get benefits if

they’re age 62 or older. For your parents to be eligible

as dependents, you must have provided at least half of

their support.

Dave Ramsey clarifies how Social Security benefits work

Social Security is financed through payroll taxes — specifically FICA and self-employment taxes — that are contributed by millions of diligent American workers, Ramsey explains.

These taxes continue to represent a substantial portion of earnings that many individuals never directly see, as they’re automatically deducted from each paycheck. In 2025, the Social Security tax rate remains at 12.4%.

For Americans employed by someone else, this cost is shared equally between the employee and the employer, with each contributing 6.2%. Those who are self-employed, however, are responsible for the full 12.4%, though they can deduct half of that amount as a business expense when filing their taxes.

More on personal finance:

- Dave Ramsey sends strong message on housing costs

- Scott Galloway explains his views on retirement, Social Security

- Tony Robbins makes key statement on IRAs, 401(k)s

Ramsey notes that there’s a ceiling on how much income is subject to this tax. For 2025, only the first $176,100 of a person’s earnings is taxed for Social Security purposes — a $7,500 increase from the previous year.

Any income earned beyond that threshold is not subject to the Social Security portion of payroll taxes, which can result in significant savings for high-income earners.

Ramsey identifies a key point about Social Security

Ramsey emphasizes that these taxes aren’t being saved for the future of the person paying them. Instead, the money is immediately distributed to current Social Security recipients, known as beneficiaries.

It’s a pay-as-you-go system, not a personal savings account. Right now, it takes contributions from nearly three workers to support the benefits of one retiree — specifically, 2.7 workers per beneficiary.

And the trend is heading in a troubling direction. By 2035, the ratio is expected to drop to just 2.4 workers for every beneficiary, while the number of people receiving benefits will surge from 61 million to 77 million.

Related: Dave Ramsey has blunt words for Americans on Medicare, Medicaid