Traditional banks and agile neobanks in Western Europe are creating an integrated and personalized banking experience that emphasizes cocreation, extensive digital upgrades, and native digital efficiencies.

Portugal’s Millennium bcp has focused on cocreation with SMEs to develop a platform that simplifies complex processes and enhances accessibility, aligning with the broader trend toward a seamless, integrated, and personalized banking experience. Its success in digital transformation, recognized by high satisfaction scores, showcases how established banks are adopting a fintech-like approach to meet client needs. Turkey’s Isbank has also simplified and significantly upgraded its digital services, offering fully digital onboarding and a revamped super-app.

The banks prioritize an intuitive and efficient digital experience. Isbank leads in open banking and introducing comprehensive digital treasury and cash management tools. While Millennium bcp emphasizes integrating external services for billing and taxes, Isbank focuses on AI-powered cash flow forecasting and real-time account surveillance.

Spain’s BBVA prioritizes embedded finance, with dedicated teams driving growth in its partner network and customer acquisition. Specialized teams handle partnership origination, development, and support by identifying platforms, codeveloping integrated solutions, and driving usage. After launch, partner-relationship managers oversee quality, performance, and compliance while also identifying new use cases. This comprehensive approach has enabled rapid scaling of the bank’s embedded finance footprint, delivering contextual financial services within trusted platforms.

BBVA’s embedded finance capabilities stand out through API-based solutions that address clients’ operational needs and can be delivered where needed, making banking simple, immediate, and relevant. Financial services support businesses’ operational needs by adding value within partners’ platforms.

A reverse factoring API with a syndicated model automates and centralizes supplier payments, enabling the real-time processing of large volumes of invoices for same-day payment and risk sharing, without requiring direct engagement with BBVA channels. Treasury APIs for SMEs integrate seamlessly into SME systems, making cash flow, collections, and payment processing easier. Embedded vehicle financing helps dealers increase sales and improve customer satisfaction.

Revolut, a UK neobank, exemplifies the core principles of speed, accessibility, simplicity, and protection that traditional banks like Millennium bcp and Isbank are working to integrate into their offerings. Although they seek to enhance existing corporate banking through digital transformation, Revolut was built from the ground up with these digital efficiencies in mind, providing a comprehensive solution within a single app. All three seek to address common pain points in traditional banking and position themselves as strategic financial partners—whether through cocreation with clients (Millennium bcp), extensive digital upgrades (Isbank), or a digital-native approach (Revolut).

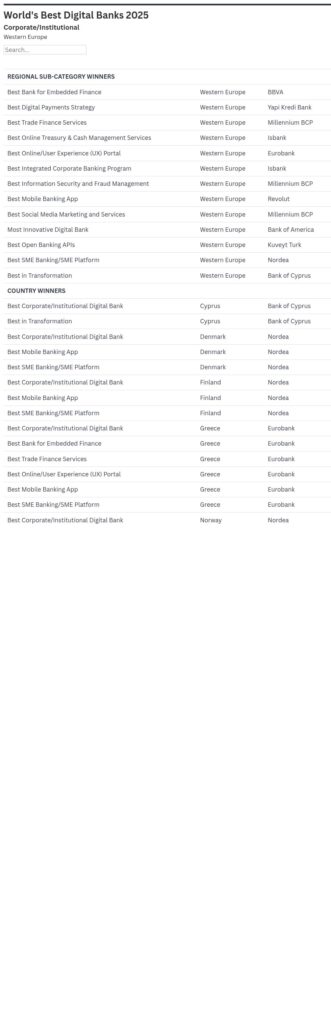

The post Best Corporate/Institutional Digital Banks in Western Europe 2025 appeared first on Global Finance Magazine.