Full Video Transcript Below:

CAROLINE WOODS: Dan Ives, managing director and senior equity research analyst at Wedbush Securities. Dan, always great to have you. Thanks for joining us.

DAN IVES: Great to be here.

CAROLINE WOODS: All right. So Nvidia beat on both the top and bottom line. The stock has been both higher and lower this morning, currently down about 2%. You walked away from those results feeling what?

DAN IVES: I’m feeling more bullish because when you factor even in the China numbers, I mean this is ultimately really just the start of an acceleration for Nvidia across the board. And even though some will pick at maybe the data center numbers and say it wasn’t as good as expectations, I think when you factor it in, this is ultimately going to be—when you talk about China, it could be a $50 billion market next year.

CAROLINE WOODS: But the data center revenue was a miss. So what does that tell you about AI momentum?

DAN IVES: Look, I think this is just what I view, especially with China. It’s just more transitional. I mean, when you look at data center over the coming quarters, you’re actually going to see an acceleration. I think the Street’s still underestimating growth by 25% to 30%. That continues to be our focus. And look, me and you have talked about it before — it’s very easy to get caught up in these knee-jerk reactions. I think overall, these are numbers that make you more bullish, not less.

CAROLINE WOODS: But can the momentum continue without China? Because we did learn that Nvidia sold no H20 chips to China during the quarter. We don’t necessarily know when that business could pick back up, and we know that Chinese competition continues to heat up. So can we see the stock continue to rally? We’ve already seen this impressive run-up without China.

DAN IVES: Look, China is a key part of not just the AI revolution, but of course for Nvidia itself. So that is going to play a huge role. But it’s our view that the biggest chip on the poker table is Nvidia when it comes to U.S.-China. And I do think that the green light will be there. It’s a pay-for-play model. And I think when you start to factor China revenue in, that’s where this is a game changer to the story. They’re being conservative, right? And the Street will continue to see through it.

CAROLINE WOODS: So what is the biggest risk to Nvidia right now, Dan?

DAN IVES: Well, the biggest risk is obviously about China, right? They’re caught in the crossfire of U.S. and China. If a war of words continues or if they continue to see delays, that is a huge part of the upside in the story. But like I’ve said, I think it’s just a matter of time till that gets green-lighted. And even when you look at H20, when you look at some sort of restricted black chip, that’s ultimately where I see the future in terms of Nvidia selling into China.

CAROLINE WOODS: Did we get any more understanding from the earnings call about when we could see that green light for China?

DAN IVES: Look, I think this is something that we’re probably going to see in the next 45 to 60 days. I do believe at one point this quarter, we ultimately start to see that come through. Timing will be an issue. But I think Nvidia—look, if you look at Jensen, he’s 10% politician, 90% CEO.

CAROLINE WOODS: So you have your sights set on $5 trillion market cap for Nvidia. When does it hit $5 trillion?

DAN IVES: I think by early ’26. And look, the doubters will continue to be there. But to me this is really just the next phase of the story, now set to play out. And I think not just for Nvidia, but overall tech — you walk away from these numbers feeling more bullish about the thesis.

CAROLINE WOODS: So Nvidia of course was the last of the Mag 7 to report. What’s the next catalyst for tech stocks then?

DAN IVES: The next catalyst is clearly going to be U.S.-China, right? Like what we see in terms of deals, chip, more of a pay-for-play model. I think that continues to be the big focus from a tech perspective.

CAROLINE WOODS: And what’s priced in at these levels? Where do tech stocks go from here?

DAN IVES: Look, I think tech stocks are up another 8% to 10% the rest of the year. I think you now have the validation that we see in terms of these names. And I think these stocks continue to move higher based on everything we see playing out across not just earnings but our checks.

CAROLINE WOODS: So when we last spoke in June, I asked if you could only buy one tech stock then what would it be. And you said Palantir. I’m switching my question. If you could only buy one Mag 7 stock right now, which would it be?

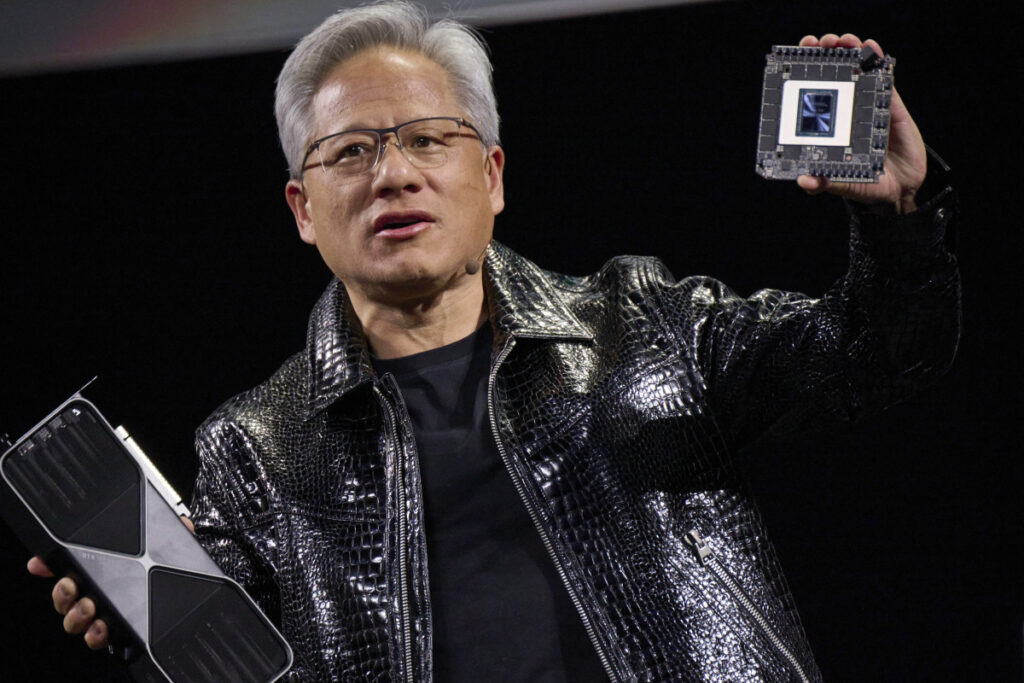

DAN IVES: It would have to be Nvidia, because there’s only one chip fueling the AI revolution. And that continues to be the godfather of AI: Jensen, Nvidia.

CAROLINE WOODS: OK, so Dan I have some This or That questions for you. I know you’re bullish on the overall space, I know you’re bullish on AI, but I want to get you to make some choices here. More upside from here: Tesla or Nvidia?

DAN IVES: Tesla.

CAROLINE WOODS: Better AI winner over the next 12 months: Alphabet or Microsoft?

DAN IVES: Microsoft.

CAROLINE WOODS: More resilient if the consumer slows: Apple or Amazon?

DAN IVES: Apple.

CAROLINE WOODS: Better AI moat: Microsoft or Amazon?

DAN IVES: Clearly Microsoft.

CAROLINE WOODS: Bigger AI beneficiary over the next five years: semiconductors or software?

DAN IVES: Software, because continued use cases will really be the golden goose for AI. But Nvidia is still the name that you would pick.

CAROLINE WOODS: So still top pick Nvidia?

DAN IVES: Yes.

CAROLINE WOODS: Now I have one for you. In the Super Bowl: Giants or Jets?

DAN IVES: No — Bills. Bills all the way.

CAROLINE WOODS: All right, a few more. If you had to go all in on one theme right now: AI, cloud or cybersecurity?

DAN IVES: AI.

CAROLINE WOODS: More vulnerable to regulation: Alphabet or Meta?

DAN IVES: Alphabet, clearly, because of the DOJ.

CAROLINE WOODS: Which Mag 7 stock has the most China risk?

DAN IVES: That would have to be Nvidia, because of everything we’ve talked about.

CAROLINE WOODS: Sleeper tech stock that’s not talked about enough?

DAN IVES: Pegasus.

CAROLINE WOODS: Better SaaS pick: Salesforce or Snowflake?

DAN IVES: Snowflake.

CAROLINE WOODS: Which Mag 7 member falls out of the group first?

DAN IVES: None.

CAROLINE WOODS: Bigger bubble risk right now: AI stocks or EV stocks?

DAN IVES: Neither. There’s no bubble risk.

CAROLINE WOODS: And finally, Mag 7 name that tests your bullishness the most?

DAN IVES: Probably Tesla, because they’re in a transition to the AI stage. But still bullish. Two trillion market cap.

CAROLINE WOODS: All right, and just finally Dan, going back to Nvidia. I didn’t see any price target changes in your note. So you’re more bullish on Nvidia, but not bullish enough to raise your price target?

DAN IVES: Base case: $1,250. Bull case: $1,500.

CAROLINE WOODS: All right, we’ll leave it there. Dan Ives, always appreciate you joining us.

DAN IVES: Thank you.