Retirement planning in America increasingly hinges on the interplay between personal savings and Social Security.

The program pays benefits to about 70 million people, with an average monthly benefit of $2,006.69, according to Social Security Administration (SSA) data.

Yet, with the main Social Security trust fund projected to be depleted by 2033, many financial experts urge Americans to prioritize independent savings strategies.

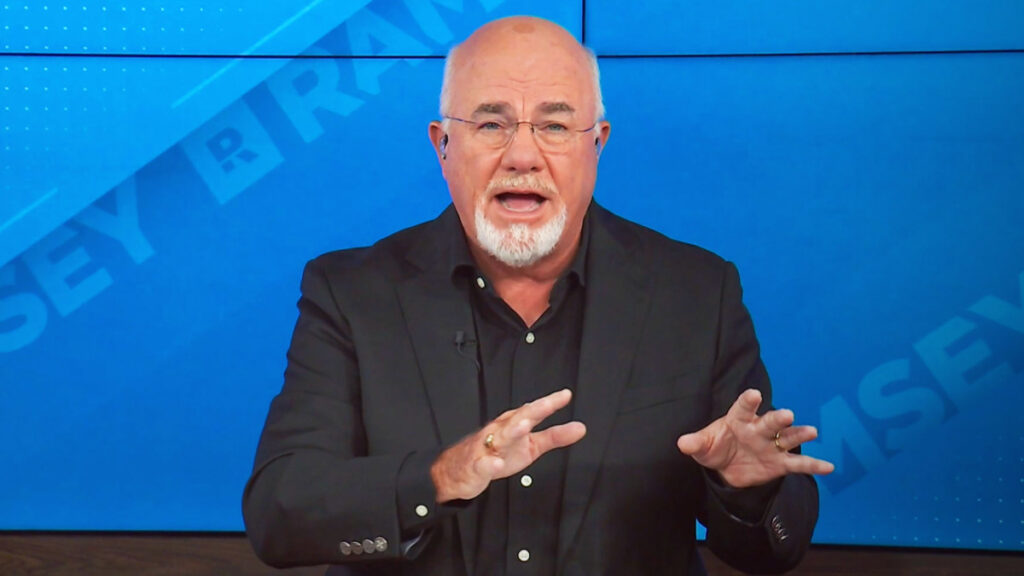

Dave Ramsey, the bestselling personal finance author and radio host, has long advocated for aggressive retirement savings and minimal reliance on government programs. He has a warning for Americans:

Your financial security in retirement shouldn’t come from Social Security — it should come from what you’ve saved over your working lifetime. You are the CEO of your retirement.

Ramsey’s retirement philosophy centers on personal responsibility

Ramsey’s approach to retirement is built on the principle of self-reliance. He encourages individuals to save aggressively, invest wisely, and avoid debt at all costs.

In his view, retirement should be funded by personal savings — not government programs.

Ramsey emphasizes the importance of investing 15% of household income into retirement accounts such as Roth IRAs and 401(k)s. He also recommends using mutual funds with long-term growth potential and avoiding risky speculation.

Ramsey’s seven “baby steps” — his framework for financial wellness — culminate in building wealth and giving generously.

He argues that consistent investing over decades can yield substantial returns, allowing retirees to live comfortably without relying on Social Security.

Image source: TheStreet

Dave Ramsey’s 7 baby steps to financial wellness

The following are what Ramsey calls “baby steps” on which Americans should focus.

- Step 1: Save $1,000 for your starter emergency fund.

- Step 2: Pay off all debt (except the house, because there is important equity involved).

- Step 3: Save 3 to 6 months of expenses in a fully funded emergency fund.

- Step 4: Invest 15% of your household income in retirement accounts.

- Step 5: Save for your children’s college fund.

- Step 6: Pay off your home early.

- Step 7: Build wealth and give generously.

More on personal finance:

- Dave Ramsey sends strong message on housing costs

- Scott Galloway explains his views on retirement, Social Security

- Tony Robbins makes key statement on IRAs, 401(k)s

Ramsey’s skepticism about Social Security is rooted in both fiscal concerns and philosophical beliefs.

He frequently refers to the program as “Social Insecurity,” warning that it may not be a reliable source of income for future retirees.

Dave Ramsey’s advice for late starters on retirement savings

Ramsey encourages people who feel they have waited too long to invest in their retirement future to remain optimistic and focus on important goals. He makes this point:

If you’re in this group, you’re in a tough spot — there’s no way around it. We understand that you’re anxious about your future, and you may be beating yourself up for not taking action sooner.

Related: Dave Ramsey bluntly speaks on 401(k)s, IRAs

He then explains that Americans can still get the job done, no matter how old they are.

It’s time to put an end to all that. It’s true that there’s no magic formula that will instantly give you a multi-million-dollar nest egg, but with careful planning, disciplined budgeting and a positive outlook, you can build a decent retirement fund that will keep you content.

Dave Ramsey offers more advice on retirement savings, Social Security

Some financial experts advise individuals planning for retirement to operate as if Social Security won’t be available, Ramsey explains.

If it is still around when retirement arrives, that’s a bonus — but if it’s not, there’s no financial shock. Still, for many Americans, Social Security will be a significant part of their monthly income.

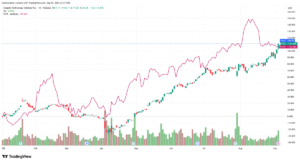

Those who can delay claiming benefits until age 70 stand to receive substantially more. For instance, someone retiring at 62 this year could receive up to $1,992 per month, while waiting until 70 could increase that amount to $3,425.

Individuals who consistently contribute to retirement accounts and take full advantage of available savings options could accumulate over $250,000 by age 70. That nest egg, if invested wisely, could provide financial support for two to three decades of retirement.

Everyone’s circumstances are different, but the concerns are often the same, Ramsey writes. Am I too late to start? Will I have enough?

The key is not to dwell on past delays but to take action now, he says. Evaluate your financial situation honestly, reduce unnecessary expenses, and commit to a focused, disciplined savings strategy.

The sooner you begin, the more options you’ll have later.

Related: Dave Ramsey sends strong message on housing costs