Recession warnings are everywhere, but Mark Zandi’s hits different.

The Moody’s chief economist, who flagged the 2007 housing collapse before most dared calling it a bubble, now sees serious recession risks hiding in plain sight.

Beneath the numbers, Zandi is seeing a labor market that’s quietly unraveling, dissecting undercurrents that the market’s ignoring.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

These typically aren’t the signals investors typically focus on, but for Zandi, these matter the most given the current setup.

And when he points below the surface, history says it’s best to listen.

Image source: Bloomberg/Getty Images

Who is Moody’s Analytics Chief Economist Mark Zandi?

Mark Zandi is a popular longtime chief economist at Moody’s Analytics and is perhaps one of the most quoted names during economic crises.

He became a regular fixture in Washington during the 2008 financial meltdown, essentially becoming the “explain-and-forecast” guy for lawmakers and the media.

In fact, when the much-talked-about $787 billion stimulus package was being discussed in early 2009, then-House Speaker Nancy Pelosi cited his research on multiple occasions in press briefings to build support.

Related: Legendary fund manager Stanley Druckenmiller buys $133 million of under-radar AI stock

His models underscored the importance of a stimulus and unemployment benefits to supercharge the GDP and the job market.

However, Zandi’s credibility was mostly built in 2006-2007, before the crash. His now-famous report, Housing at the Tipping Point, warned of the remarkably high odds of national housing prices dropping in 2007.

He called it the first national price drop since the Great Depression. Also, he flagged more than 100 U.S. metro areas at risk while projecting double-digit declines that later materialized in multiple key markets.

Moody’s Mark Zandi sees recession risks rising

Moody’s Analytics Chief Economist Mark Zandi just sounded the alarm on the U.S. economy, zeroing in on the labor market as the primary weak link.

“Yeah, I think recession risks are really high,” he said on CNBC’s “Money Movers.” “I think the key here is jobs.”

Zandi notes the latest job reports have effectively stalled out.

“With the recent data, we’ve seen jobs data come to a virtual standstill, and I don’t see any reason why we’ll see any pick up here anytime soon.”

Sadly, the numbers back him exactly what he’s pointing towards. July added just 73,000 jobs, and previous months were quietly revised down by 258,000.

That puts the three-month average around the 35,000 mark — sluggish speed, to say the least.

Source: U.S. Bureau of Labor Statistics

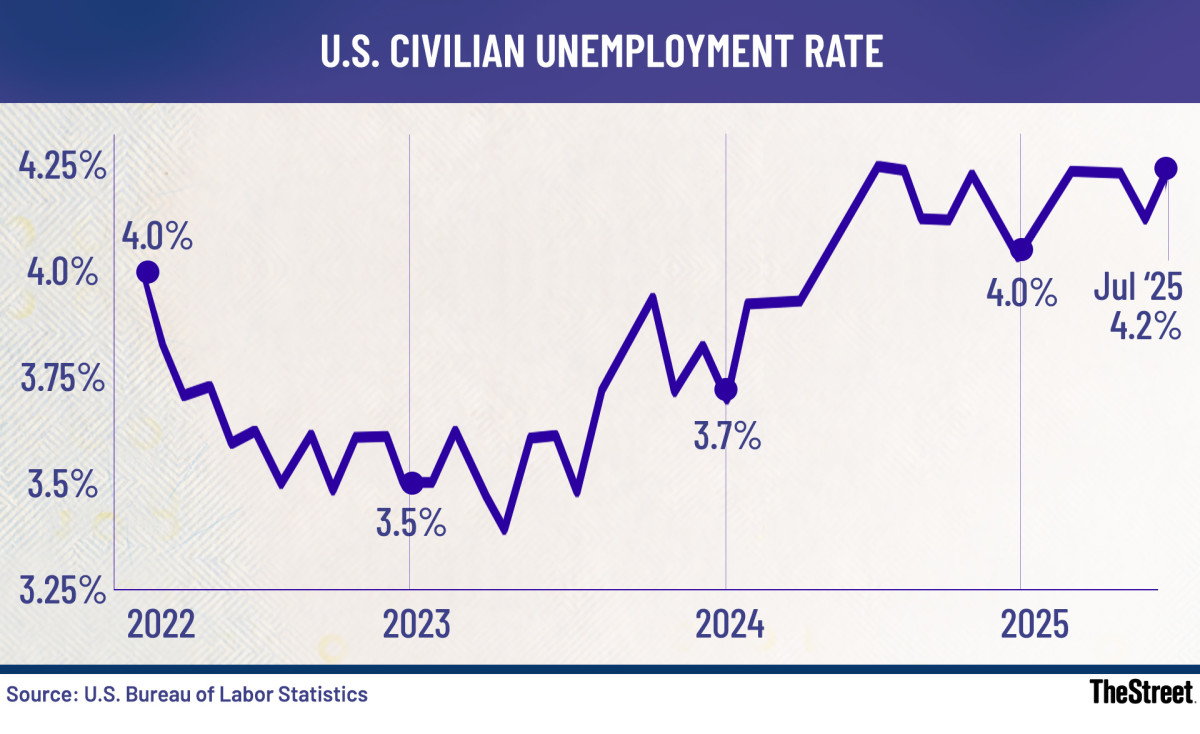

Unemployment’s stuck at 4.2%, and quits held at 2.0%, which is a clear sign that workers aren’t feeling bold. This setup puts the economy perilously close to a downturn.

Perhaps the real danger he senses is that we start seeing negative prints.

“If we start getting some negative job numbers, which I think is really very possible, that would be a clear indication of a recession.”

Typically, a 0.5-point unemployment bump signals recession. However, with flat immigrant labor growth at this time, that signal has gotten a lot fuzzier.

Related: Top tech stock analyst revamps AI ‘buy’ list

Zandi feels payroll employment, which is the monthly change in jobs added or lost, is perhaps a cleaner measure at this point. If payrolls turn negative, it means businesses are actually cutting jobs rather than having just a tough time absorbing new workers.

Simply put, fewer jobs equals less spending equals sluggish growth, which makes payrolls a much sharper recession signal.

The numbers behind today’s recession risk

The National Bureau of Economic Research (NBER) describes a recession a lot more broadly, which is a “significant decline in economic activity, spread across the economy, lasting more than a few months.”

In assessing recessionary risks, NBER typically looks at the breadth and duration across multiple core metrics, which include payroll employment, real personal income, industrial production, and real sales.

One critical trigger is the Sahm Rule, which Zandi alluded to as well, where the three-month average unemployment rate rises 0.5 percentage points above its 12-month low.

More News:

- Billionaire George Soros supercharges Nvidia stake, loads up on AI plays

- Tesla just got its biggest break yet in the robotaxi wars with a key permit

- Bank of America drops shocking price target on hot weight-loss stock post-earnings

Another reliable signal is the yield curve. When short-term interest rates zoom past the long-term ones (called inversion), markets are betting on sluggishness in growth numbers. That happened in late 2022 and persisted through 2024.

Fast forward to mid-2025, and a look at the key metrics shows that inflation has cooled (CPI +2.7%, core +3.1%), but growth has, too.

The low confidence among the labor force was already discussed earlier, and the Conference Board’s Leading Economic Index (LEI) dropped 2.8% in the first half of 2025.

The yield curve is now steepening again, which is not exactly a sign of good health, but a shift in risk. The bottom line is that the inflation panic may be over, but the threat of a slowdown is still very much in play.

Related: Billionaire fund manager doubles down on Nvidia, partner in AI stack shift