Inflation isn’t fun… for anyone. Higher prices mean cash-strapped consumers and businesses have to make tough choices on spending, cutting purchases and shelving plans.

Many may have thought the worst of inflation was in the rearview last year after the Fed finally and successfully wrestled runaway inflation in 2022 down below 3%. Unfortunately, inflation is making an unwelcome return, and the reason — tariffs — is about as polarizing as it gets.

President Trump’s administration has made tariffs a policy cornerstone, confident they’ll force a resurgence of U.S. manufacturing greatness. Critics say they’re just another costly tax on businesses and consumers likely to make the things we buy more expensive.

Only time will tell who is right or wrong, but tariffs aren’t going away without a fight based on Treasury Secretary Scott Bessent’s NBC’s Meet the Press with Kristen Welker interview.

When Bessent, a former hedge fund manager trained by legendary money manager Stanley Druckenmiller, was pressed on tariffs’ real world impact, including on inflation, jobs, and corporate profits, his responses were blunt and perhaps, even snarky, at least regarding Wall Street powerhouse, Goldman Sachs.

Inflation makes unwanted comeback

If you weren’t a fan of it the first time around, you’re certainly not going to like it again now. Inflation, which has surged over 8% in 2022, is making a comeback this summer after falling below 2.5% this spring.

Image source: Bloomberg/Getty Images

The reason? Tariffs. Despite trade negotiations, the President’s plan to respark U.S. manufacturing includes stiff import taxes, particularly on key countries and industries.

“The actual average effective tariff was 10% in June and likely about 10% and 11.5% in July and August respectively, versus 2.4% at the beginning of the year,” writes Yale’s The Budget Lab.

The increased tariffs are flooding the U.S. coffers, adding an estimated $23 billion alone in August, according to The Budget Lab. But somebody has to pay, and when it comes to tariffs, importers either have to:

Related: Goldman Sachs revamps S&P 500 target for 2026

- Negotiate lower prices from suppliers

- Absorb the expense, reducing profits.

- Pass along the costs to buyers.

The tactic most are embracing: Some combination of the three. Walmart, for example, is lowering prices on some goods, absorbing costs on others, and increasing prices for shoppers when necessary.

Goldman Sachs said in an August 10 note shared with TheStreet, that much of the tariff revenue collected so far has been footed by either the company or the consumer.

“Foreign exporters had absorbed 14% of the cost of all tariffs implemented so far through June, but that their share will rise to 25% if the more recent tariffs follow the same pattern as the earliest tariffs on China. … US consumers had absorbed 22% of tariff costs through June but that their share will rise to 67% if the recent tariffs follow the same pattern as the earliest ones. This implies that US businesses have absorbed more than half of the tariff costs so far but that their share will fall to less than 10%,” wrote the analysts.

Consumer Price Index (CPI) inflation has climbed steadily since April as tariffs have been implemented.

- July: 2.7%

- June: 2.7%

- May: 2.4%

- April: 2.3%

Bessent pushes back on tariffs impact on inflation

The impact of tariffs on inflation will be front and center this week ahead of the August CPI report on Sept. 11. The consensus among Wall Street analysts is that headline CPI increased to 2.9% in August, up from 2.7% in July.

Related: Bank of America announces huge shift in Fed rate cut forecast

On NBC’s Meet the Press, Kristen Welker asked Bessent, “Mr. Secretary, do you acknowledge that these tariffs are attacks on American consumers?”

Bessent responded blunty, “No, I don’t.”

Welker continued, pointing toward Goldman Sachs study. Bessent’s reply was once again blunt, and perhaps humorous:

“You’re quoting Goldman Sachs,” responded Bessent. “I made a good career of trading against Goldman Sachs.”

Bessent pushes back on tariff hit to corporate profits

The increased import taxes have led to many companies discussing their impact on their bottom lines. During second quarter earnings conference calls, 355 of S&P 500 companies mentioned tariffs, reports Barron’s, according to FactSet.

More Economic Analysis:

- Fed official sends bold 5-word message on September rate cuts

- New inflation report may have major impact on your wallet

- Surprising GDP report resets backdrop for stocks

Mostly, those mentions tackled the negative impact to profits caused by tariffs or the needs to raise prices on some goods. JM Smucker’s said it raised coffee prices in August for a second time this year with another increase likely this winter, Stanley Black & Decker similarly boosted prices on tools, and retail giant Target said produce prices were going up because of them.

Welker focused instead on agricultural equipment maker John Deere, asking Bessent about comments made by the company that tariffs cost it $300 million “so far” with $300 million more by year’s end. She asked, “What do you say to companies like John Deere who say these tariffs are hurting them?”

Bessent said that he’s hearing from many more companies who are talking more positively about their businesses.

“For every John Deere we have companies who are telling us, “The tariffs have helped our business,” responded Bessent. “We’re increasing CapEx. And we’re going to increase employment.”

Bessent on manufacturing boost

The main argument made by the Trump Administration is that tariffs are good for the manufacturing industry because they’ll spark new factories and increase jobs.

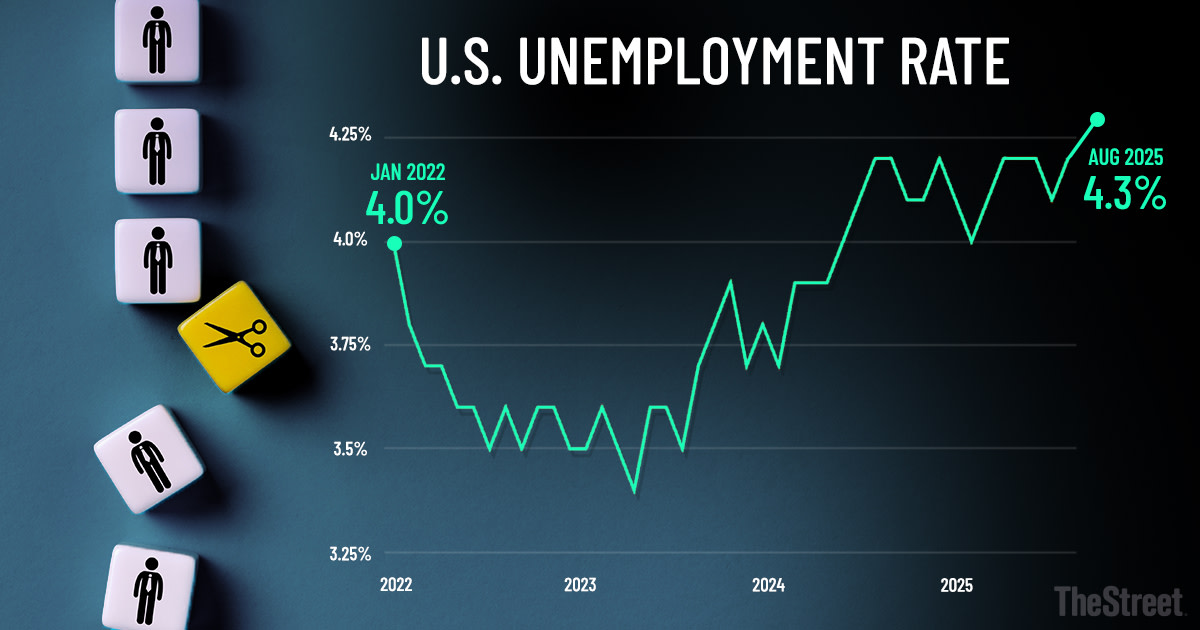

Welker points out that we’ve yet to see that happen. Nationwide, unemployment in August climbed to a new cycle high of 4.3%, the biggest rate since October 2021.

TheStreet/Shutterstock

According to the August BLS Employment Situation Summary, manufacturing employment is “down by 78,000 over the year.”

When asked about manufacturing jobs, Bessent advocated for patience.

“It’s been a couple of months. And with the manufacturing sector, as you know, you know, we can’t snap our fingers and have factories built. “The One Big Beautiful Bill which has full expensing for factories and equipment was passed on July 4th. Many companies were holding back then. So we are going to see construction jobs. And we are going to see manufacturing jobs.”

Related: Forget rate cuts: Veteran analyst rings alarm on S&P 500