This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Sept. 4, 2025. You can follow the latest updates on the market here with our daily live blog.

Update: 7:32 a.m. ET

Challenger Job Cuts See Highest August Showing Since 2020

Challenger Job Cuts are out now, up 13.3% year-over-year in August to 85,979. The cuts are the highest we’ve seen in the month of August since 2020.

Update: 7:22 a.m. ET

Investors’ Most-Anticipated Economic Report Awaits

Earlier this week, I had an opportunity to talk with Lightcast Senior Economist & Principal Researcher Elizabeth Crofoot about what has shaped up to be the most anticipated economic report of the year: August payrolls.

It’s important because investors expect that it holds the key to whether the Fed will ultimately cut in their September Federal Open Market Committee meeting. That crucial data is out tomorrow, but today, we’re getting a glimpse of what lies in store as we get a few job data reports.

However, I was struck by more than a few things that Crofoot shared, including the market’s need to acclimate to a new normal. Gone are the days of 100,000, 200,000 or 300,000 job additions per month; 3% unemployment; and 10 million open jobs. For those interested in reading about the change in the market, we did a little write up that’s worth the read:

Related: We’re entering a “new normal” in the job market, says Lightcast senior economist

Earnings Today: Broadcom, Copart, Lululemon

Nasdaq says there’s 54 reports due out today, mostly this evening. Headlining the major reports is semiconductor megacap Broadcom (AVGO) , Copart (CPRT) , and Lululemon Athletica (LULU) .

Here are the ten largest reports of the day, per TipRanks:

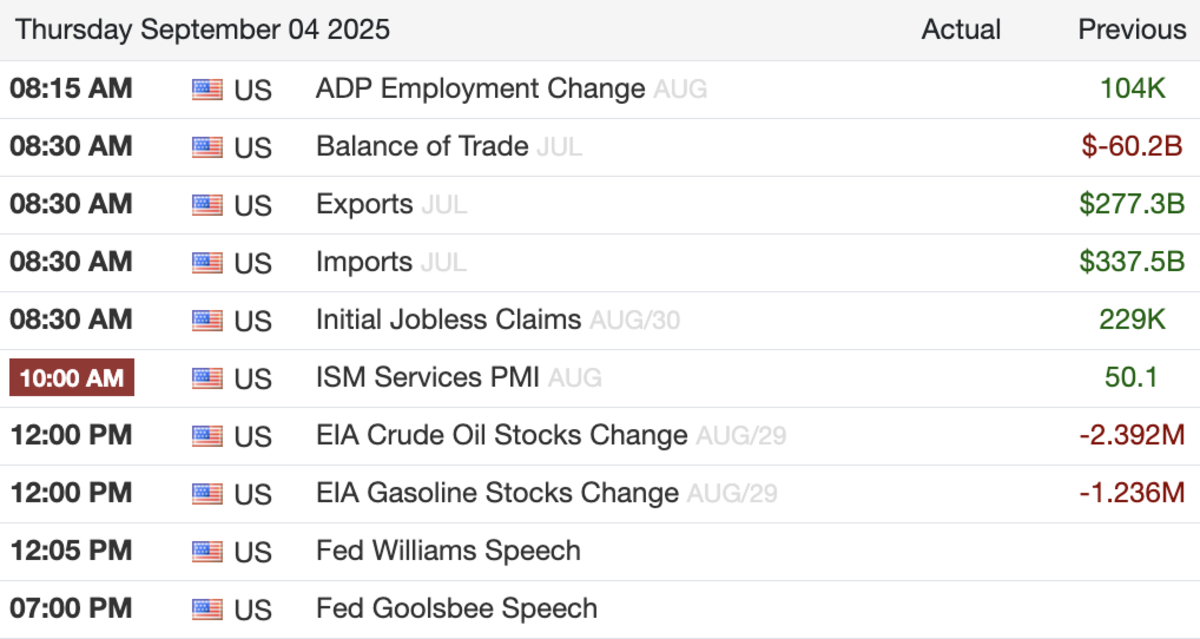

Economic Data: ADP Employment Change, Balance of Trade, ISM Services PMI

Early this morning, market participants will get an early preview of tomorrow’s payroll reports with the Challenger Job Cuts, ADP Employment Change, and Initial & Continuing Jobless Claims.

Later this morning, we’ll get the S&P Global PMI and ISM Services PMI reports; the latter of which might have the biggest ramifications for the market.

Here are the most pertinent reports, sorted by impact in TradingEconomics:

TradingEconomics