And now a few words from Douglas Adams.

Adams, the master mind behind the comedy science fiction franchise “The Hitchhiker’s Guide to the Galaxy,” has a two-word message emblazoned on the cover of the eponymous handbook for star-searching souls in need of encouragement.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💵

Don’t Panic.

Yeah, that’s it. And though the story of Arthur Dent, who escaped Earth’s destruction, debuted in 1978, that phrase comes in handy for those currently traveling through the investing universe.

TheStreet Pro’s Ed Ponsi recently invoked Adams’s iconic counsel in a column about AI-chip phenomenon Nvidia (NVDA) .

Ponsi, managing director of Barchetta Capital Management, recalled that one of his mentors liked to say “it’s not time to panic because it’s never time to panic.”

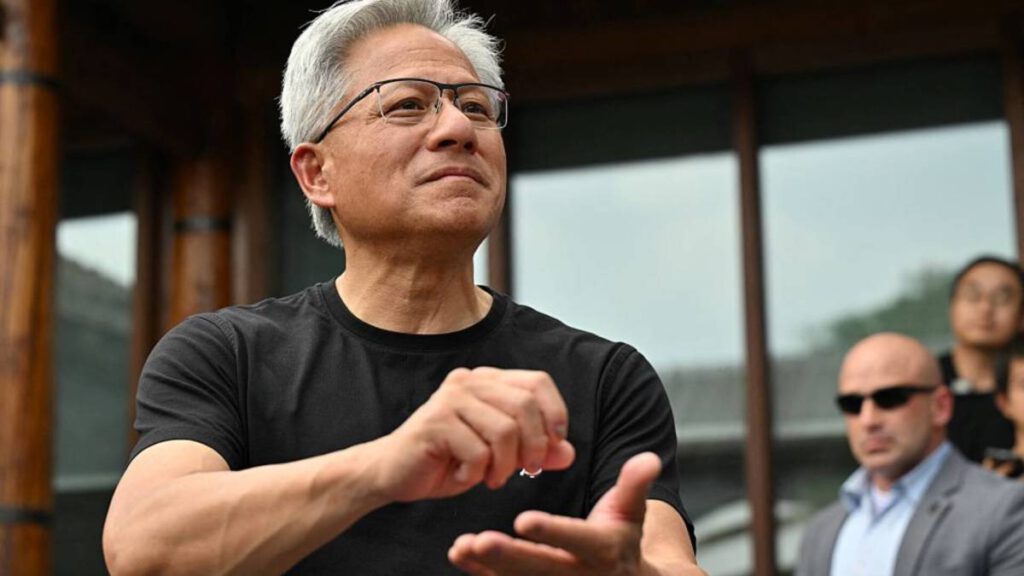

Image source: Berry/AFP via Getty Images

Nvidia CEO cites importance of China market

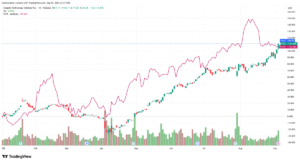

“Nvidia is probably the most talked about stock in our universe,” he said. “Over the past five years, this stock has gained over 1,200%.”

The Santa Clara, Calif., company has climbed 76% since May 6, when Ponsi wrote that the stock was “about to steal the spotlight” after several months of uninspired trading.

“Not bad for a $4.3 trillion stock,” he said.

More Nvidia:

- Veteran Nvidia analyst drops blunt 4-word message on its future

- 8 Quotes from Nvidia CEO Jensen Huang on what happens next

- Veteran analyst drops surprising twist on Nvidia stock post-earnings

On Aug. 27 Nvidia beat Wall Street’s quarterly expectations for revenue, posting a 56% rise to $46.74 billion.

“We delivered another record quarter while navigating what continues to be a dynamic external environment,” Chief Financial Officer Colette Kress said during the earnings call with analysts.

Nvidia sells AI chips in China through specific lower-performance products like the H20 chip, which are designed to comply with U.S. export restrictions.

“In late July, the US government began reviewing licenses for sales of H20 to China customers,” Kress told analysts. “While a select number of our China-based customers have received licenses over the past few weeks, we have not shipped any H20 based on those licenses.”

Kress said Nvidia could ship between $2 billion and $5 billion in H20 revenue during the quarter if the geopolitical environment permits.

Nvidia CEO Jensen Huang met with President Donald Trump at the White House in July.

“About 50% of the world’s AI researchers are in China,” Huang said during the earnings call. “The vast majority of the leading open-source models are created in China, and so it’s fairly important, I think, for the American technology companies to be able to address that market.”

Ponsi described Nvidia as “the poster child for AI” and noted that due to its vast size, the company is now the largest component of several key weighted indexes.

The stock currently represents 13.5% of the Nasdaq 100 and 7.2% of the S&P 500.

“Because of its size and influence, if something bad were to happen to Nvidia, the stock could simultaneously take down those two indexes, along with the AI sector,” he said.

Ponsi said he had received several panicky messages on Sept. 2 imploring him to take a look at Nvidia’s chart.

“I wouldn’t describe what I found as alarming, but investors need to be aware of a few key points,” he explained.

Veteran trader Ponsi: every rally has pullbacks

The company’s stock fell 1.95% on that day, with a record $39.01 billion trading volume driven by sector weakness, rising Treasury yields and geopolitical risks.

Nvidia closed below its 50-day moving average for the first time since May 1 and its stock fell to its lowest closing price in more than a month.

Related: Analysts turn heads with Nvidia rival’s stock target after earnings

“A bearish pattern appears to be forming on Nvidia’s chart,” Ponsi said. “The formation suggests that Nvidia could see a decline to the $157 area. The stock last traded at that level two months ago, on July 2. That’s a pullback I can live with. There’s no reason to panic.”

Nvidia has also been contending with concerns about a shortage of H100/H200 GPUs.

The company posted a message on X blasting “erroneous chatter in the media claiming that Nvidia is supply constrained and ‘sold out’ of H100/H200.

“As we noted at earnings, our cloud partners can rent every H100/H200 they have online — but that doesn’t mean we’re unable to fulfill new orders,” the company said. “We have more than enough H100/H200 to satisfy every order without delay.

“The rumor that H20 reduced our supply of either H100/H200 or Blackwell is also categorically false — selling H20 has no impact on our ability to supply other Nvidia products.”

JP Morgan: NVDA lead times for sales ‘stretched, stable’

JP Morgan said in a research note that Nvidia’s demand continues to outweigh supply, which is keeping lead times “stretched but stable,” according to The Fly.

The investment firm said that even with Blackwell Ultra ramping sharply in Q2, management said lead times have remained fairly consistent.

This shows that demand is still outstripping supply more than two years into this artificial intelligence spending cycle, contends JP Morgan.

The firm affirmed an overweight rating on Nvidia with a $215 price target after hosting an investor meeting with management.

“Markets ebb and flow,” Ponsi said. “Every rally has pullbacks. We’re experiencing one now.

Are we about to go deeper?

“Maybe,” he said. “Big rallies sometimes have deep pullbacks. But there’s no cause for alarm. It’s not the end of the universe. Don’t panic.”

Related: The stock market is being led by a new group of winners